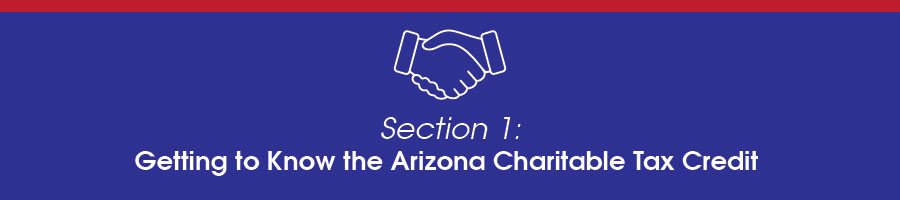

how does the arizona charitable tax credit work

Input the total of your itemized deductions such as mortgage interest charitable contributions medical and dental expenses and state taxes. A 50 tax credit would reduce the taxes you owe to 50.

Average Faculty Salary By Sector Over Time Trends In Higher Education The College Board College Board Faculties Higher Education

Like the Federal Income Tax Arizonas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

. Users may rely on this list in determining deductibility of their contributions. Complete Arizona Form A-4 and provide it to your employer. Get your tax refund up to 5 days early.

There is no head of household status for withholding formulas. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be.

It is a good practice to think of your bylaws much like the US Constitution. Who purchase and use HR Block desktop software solutions to prepare and successfully file their 2021 individual income tax return federal or state. Arizona collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Get your tax refund up to 5 days early. An audited financial statement if the organization grossed more than 500000 in revenue excluding grants from governments agencies and 501c3 private foundations. The Government does not have to take any action to create the estate tax lien.

This involves subtracting any tax credits you may be eligible for such as the Child Tax Credit or various education credits. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. Illinois collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Unlike the Federal Income Tax Illinois state income tax does not provide couples filing jointly with expanded income tax brackets. Arizonas maximum marginal income tax rate is the 1st highest in the United States ranking directly. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be.

The Estate Tax Lien. Organizational purpose board structure officer position descriptions and responsibilities terms of board service officerboard member succession and removal. Stick to the basics.

Valuation of your charitable donations. If your total itemized deductions are less than the. So if you owe 100 a 100 tax credit reduces the amount of income taxes you owe to zero.

Your marital status determines which formula your employer will use to calculate the tax to be withheld from your paycheckThis is because the tax rates and standard deduction amounts are different depending on whether you are married or single. Arizona state income tax rates range from 259 to 450. Finally under provisions of HB.

Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return. Employees who expect no Arizona income tax liability for the calendar year may claim an exemption from Arizona withholding. Illinois maximum marginal income tax rate is the 1st highest in the United States ranking directly below Illinois.

2838 6 Arizona will allow partnerships limited liability companies LLCs and S corporations to pay a 45 percent tax at the entity level instead of having all business-related income pass through to the individual income tax. Organizations whose federal tax-exempt status was automatically revoked for not filing a Form 990-series return or notice for three consecutive years. This means that the estate tax lien is in existence before the amount of the tax liability it secures is even ascertained.

A copy of any amendments to the charter bylaws or other. It does not provide for reimbursement of any taxes penalties or interest imposed by taxing authorities and does not. Tax credits directly reduce the amount of taxes you owe dollar-for-dollar.

State program download included. Like the Constitution your bylaws should deal with only the highest level of governing issues such as. Organizations eligible to receive tax-deductible charitable contributions.

The law was passed as a SALT deduction cap workaround. When an individual dies the estate tax lien automatically arises upon death for the estate tax liability. If you solicit under another name and have documents authorizing your solicitation of contributions under that name a copy of such authorization.

Employees claiming to be exempt from Arizona income tax withholding complete Arizona Form A-4 to elect to have an Arizona withholding percentage of zero.

Tax Deductions For Professional Athletes Soccer Hobbies Quote Professional Athlete

After Completing Her Master S In Social Work From Arizona State University And Clinical Hours At A Well Motivational Interviewing Behavioral Health Integrative

Jenna Castiglione Pa C Noah Neighborhood Outreach Access To Health Family Medicine Pa C Health Education

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

List Of 6 Arizona Tax Credits Christian Family Care

4 Most Popular Arizona Tax Credits A Visual Guide

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Donate To Arizona Tax Credit To Help Children Receive

Paul Dillaway Do Noah Neighborhood Outreach Access To Health Family Medicine Behavioral Health Health Education

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Arizona Tax Credits Mesa United Way

Ichoosenoah Because I Enjoy Working With A Team That Is As Passionate As I Am About Providing Excellent Q Healthy Lifestyle Habits Health Center Quality Care

Az Charitable Tax Credit Childrens Clinics In Southern Arizona

Qualified Charitable Organizations Az Tax Credit Funds

Outdoor Patio Furniture Stores Outdoor Furniture Stores Patio Store Outdoor Patio Furniture

Az Tax Credit Donations Pathway To Work

Arizona Charitable Tax Credit Guide 2020 St Mary S Food Bank